The Indian government Mr. Modi started various schemes for the farmers. Those schemes are upgraded with modern technologies. These make farmers’ physical work less and also save precious time. Through those schemes, farmers get a better life, can take loans with low interest, get crop insurances. Pradhan Mantri Fasal Bima Yojana is one of them. This scheme was first launched in 2016 to replace the existing yield insurance scheme in India. But unfortunately, most farmers not aware of this scheme and not showing interest. We must spread awareness of the benefits of Pradhan Mantri Fasal Bima Yojana.

Where Kisan Credit Card helps farmers to take loans from the government, the PM-Kisan scheme gives yearly funds, on the other and PMFBY provides insurance of crops. The special thing is that for farmers who have taken crops through Kisan credit card (KCC), their crops automatically come under insurance. Other farmers can ensure crops according to their preferences. Crop insurance can also do it from the Common Service Center without using the farmer.

It is important to note that crop insurance volunteers and complete decisions of farmers to be insured or not to be insured. Farmer’s crops are destroyed due to floods, storms, hail, heavy rainfall, or drought every year. The central government introduced the Prime Minister’s Crop Insurance Scheme (PMFBY) to save the crop from natural disasters. In this context, we bring all Pradhan Mantri Fasal Bima Yojana details with A to Z.

#What is Pradhan Mantri Fasal Bima Yojana?

Fasal Bima is the safeguard given by the government to the farmers. It is a medium that helps farmers with various problems associated with the crops. Every year natural disasters cause huge losses to the farmers. Heavy rains, storms, hailstorms, destroy crops. This scheme launched to relieve the losses of farmers caused by such natural calamities.

Under the Pradhan Mantri Fasal Bima Yojana, farmers will be able to ensure crop damage due to natural disasters. The premium for this insurance scheme is very low so that all farmers can take insurance. This is an effort by the central government to make this accessible to every farmer.

#Objectives:

The main objectives of this scheme are-

- To provide insurance cover and financial assistance under the PMFBY in case of crops damaged due to natural calamities, pests, and diseases.

- Assure to provide sustainable income and agricultural assistance to farmers to focus on agriculture.

- To show the farmers modern farming tools and modern farming methods and make them aware of all these.

- Offer to give loan for farming at low interest.

- For the benefits of farmers, online and offline applications have been arranged.

#Key Features of PMFBY:

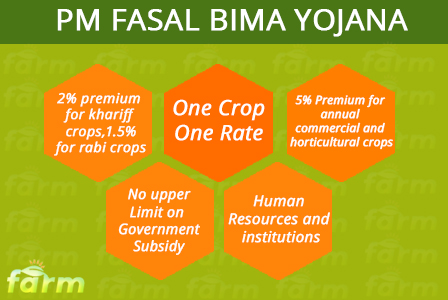

In the meeting of Prime Minister Sri Narendra Modi, an important program has been approved for the welfare of the farmers named ‘ Pradhan Mantri Fasal Bima Yojana in the central cabinet meeting. The main features of this scheme are:

1. Low Premium Interest:

For this insurance, farmers have to pay only 2% in the field of Kharif crops of the farmers and premium at 1.5% of Ravi. In the case of annual commercial and gardening crops, only 5% of the peasants will be given premiums. The remaining money of the premium of this insurance project will carry the central government. If the crop is lost due to natural disasters, the farmers will get all the insured money returned.

2. No Maximum Limit:

There are no maximum limits to government subsidies in this project. Even if the residual of this insurance premium is 90%, the government will bear it. Before that, due to the highest limit of premium subsidy rate in crop insurance, the farmers got less insured money. This decision was taken to keep the expenditure of the subsidy government in the case of insurance. As a result of the highest limit of premium subsidy in the new insurance project, the farmers will get the full meaning of insured crops.

3. Use of Technology:

The technology used in implementing this insurance project. Collect and upload cropping information using smartphones. As a result, the grain insurance of the farmers will not be delayed. Besides, the remarkable system will be used to reduce the damage to the crop collection.

4. Removing All Errata Features Of Old Projects:

The new grain insurance project will be implemented in the form of ‘one race – one project’. In this new project, the best features of the previous insurance projects will be included and the errata of previous projects will be removed.

5. Pay Premium In Once Time:

Comparison of different types of grain insurance projects can be seen in all the new insurance projects in the new insurance project, the premium rate of the farmers is the lowest. In a season, only once you have to pay premium. Earlier, the topics that were not included in natural disasters were also included in the new project. If there is a loss after harvesting, the new project will be available due to cyclone or unequal rain in the whole country. Due to natural disasters, the compensation can be claimed even if the crop is not woven. The use of technology has been compulsory in this insurance.

#Eligibility:

All farmers developing informed harvests in a told region during the season who have insurable interest in the harvest are qualified. To fulfil the demand of farmers, this scheme has been made. The farmers who have Kisan Credit Card, they are already under this scheme. If the government think to include any farmer of this scheme, he will be eligible.

According to the government rules, only those farmers can apply for this scheme who do not have any loan in the bank before. Apart from their own land, they can also apply for government land which has been given for cultivation.

#Documents Required:

- Farmer’s photo

- Farmers’ ID cards such as PAN cards, Aadhaar card, driving license, voter card, passport.

- Farmers’ residential address details.

- If the farmer is a landowner then must show the papers of land.

- Farmers have to show the proof if they sow in the land.

- If the cropland is rented then an agreement with the landowner will be required. It is important that the land information is well written in this agreement.

- A canceled check has to be given to get the money directly in the bank account due to crop loss.

#How to Apply?

There are two types of applications available for this scheme. So, the farmers must apply on offline and online forms. For Pradhan Mantri Fasal Bima Yojana online registration farmers can visit https://pmfby.gov.in/.

1. Pradhan Mantri Fasal Bima Yojana Online Apply:

- Visit the official website of PMFBY – https://pmfby.gov.in/

- Click on the Farmers Corner on the homepage

- Now login with your mobile number and if you do not have an account, log in as Guest Farmer

- Enter all the required details like name, address, age, state.

- Scanned all the required documents.

- Click the submit button at the end.

2. Offline Application:

If you want to fill out the Pradhan Mantri Fasal Bima Yojana form offline, you can go to the bank near you and ask for this scheme form. Filing the form you can submit it there. It is important to have an account in that bank as the insurance money will be available directly in the bank account. It is also important to submit the required documents with the form.

#Special Information about This Scheme:

The rate of premium under this scheme has been kept low. Find out the percentage of premium to be paid under the Pradhan Mantri Fasal Bima Yojana. Kharif crop premium rate 2.0%, Rabi crop premium rate 1.5%, Annual commercial and horticulture crops premium rate 5%.

- You have to take an insurance policy within 10 days of sowing the crop.

- PMFBY protects against losses within 14 days of harvesting.

- It will be beneficial only if there is damage due to natural disasters.

- Inform your bank immediately in case of crop damage.

Helpline:

A special helpline has been provided for any problems or queries regarding this scheme.

Number: 011-23382012/2715/2709, another number- 011-23381092.

Time: Monday to Friday, 10am to 6pm.

Email: help.agri-insurance@gov.in

The banks providing the PM’s crop insurance scheme are –

- SBI PMFBY

- HDFC PMFBY

#How To Report Crop Loss And Claim Insurance?

For crop loss, the farmer can report within 72 hours through the CSC Locator or Crop Insurance app or near agriculture officer.

Conclusion:

Keep your eyes on our website for getting the latest updates, new schemes of central and state governments. We always try to give proper information provided by the government.